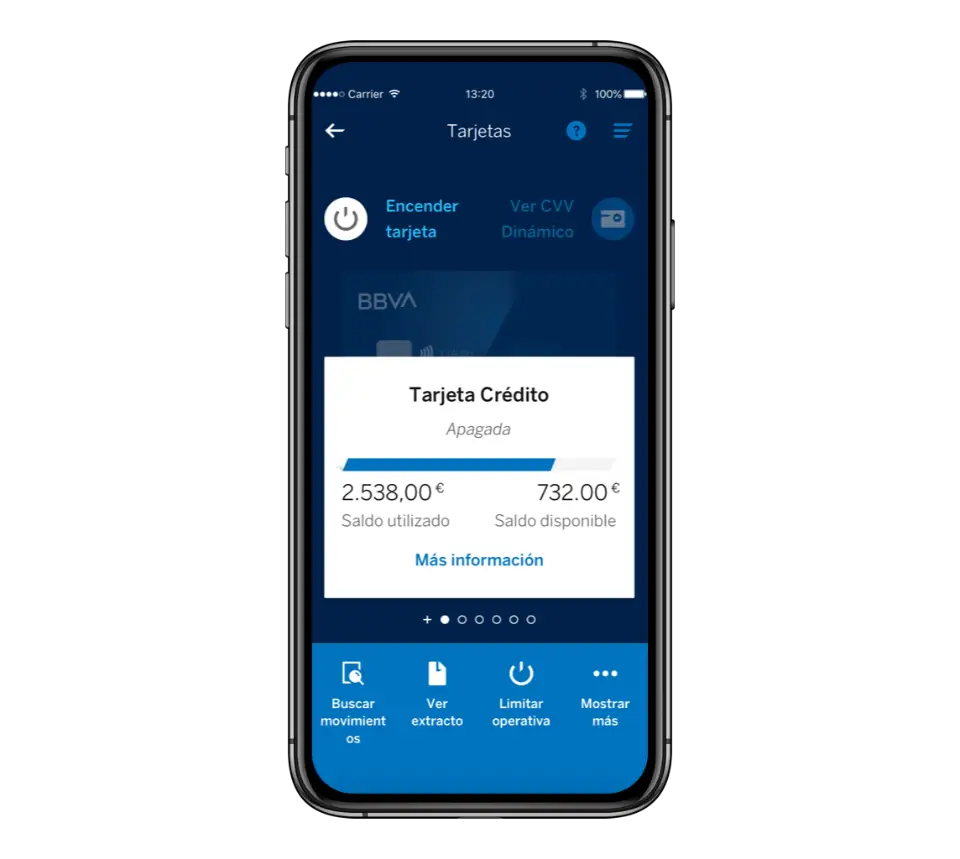

At any time, you can temporarily disconnect your cards, or cancel them completely, making it impossible for you to make online or physical purchases, money orders, payments abroad or make inquiries and withdrawals at ATMs. What happens if my BBVA card is disabled? ? Connecting and disconnecting cards is possible, fast and secure with BBVA Wallet. And if, for some reason, someone makes a payment with a ‘deactivated’ card, they’ll get a notification saying to activate it again to complete the transaction.

What happens if I disconnect the BBVA card?

With the ON/OFF option you can temporarily turn off your card so that no one can use it. In addition, you can disable money supply, online and overseas purchases. This setting is available for credit, debit and additional cards (if you are the cardholder).

How to deactivate the BBVA card?

To cancel a digital card, contact Línea BBVA through its app or by calling 55 5226 2663.

How do I know if my BBVA card is blocked?

When your credit card is blocked and it does not correspond to a blocking made by you through the «Deactivate» functionality of BBVA Móvil, you must contact the BBVA hotline in your city, where they will inform you what type of block your card has .card, if it can be unlocked during the call…

What happens if I disconnect the BBVA card?

With the ON/OFF option you can temporarily turn off your card so that no one can use it. In addition, you can disable money supply, online and overseas purchases. This setting is available for credit, debit and additional cards (if you are the cardholder).

What is card shutdown?

It is to activate or deactivate your card. A security advantage that allows you to temporarily disconnect your card without having to cancel it. It’s a very useful function if you think you’ve lost it, but you’re not quite sure, or, for example, if you’re going to travel abroad and don’t want to have it always active.

How long does a card lock last?

How long does a blocked card last? A blocked card will not work until we resolve it with the bank. If you don’t talk to them, it may expire without working again.

Why is the BBVA card blocked?

Incorrect password. If you go to an ATM or try to pay with your card and enter an incorrect password over the limit times, your account will be blocked. Contradictions between headlines. When the account has more than one holder and between them it makes movements that seem opposite.

How long is a BBVA card blocked?

Furthermore, it may happen that if the account does not register movement or balance for a period of 730 consecutive days, the entity will close it.

How long does it take to unlock a BBVA card?

Unblock your BBVA card in less than 5 minutes Once at the branch, you will be asked to unblock your BBVA card. And once they confirm that there is no security issue, they will activate your debit or credit card again.

How to unblock a BBVA card without going to the bank?

To unlock your debit card, you first need to clear the PIN. To do this, you must log into BBVA Online Banking with your digital ID, username and password. Step by step is very easy. It is only necessary to have an active security factor, be it a ‘token’ code or an SMS code.

When an account is blocked, can I deposit?

These are the daily banking operations that you will not be able to do if the bank blocks your account: You will not be able to withdraw or deposit money. You will not be able to receive or make transfers (this includes payroll or pension payments). You will also not be able to pay the payment of direct debit invoices.

How long does it take to unlock a debit card?

The time depends on the specific policies and services of each bank, but it usually takes less than 48 hours, sometimes it can even be immediate, although it depends on the particular situation.

What is the commission that BBVA charges for a debit card?

The account does not incur any cost or commission for account management or for a minimum balance. You can make as many cardless withdrawals as you like at any ATM or BBVA teller, free of charge. Remember that you can make up to 4 free withdrawals per month using your physical (plastic) payroll card.

What does it mean to deactivate a card at BBVA Colombia?

In the event of theft, loss, suspected fraud or any eventuality that occurs with your card, you can block it preventively through BBVA mobile in the «Disconnect card» option. If for some reason you are unable to block this, you can contact the BBVA hotline.

What happens if I disconnect the BBVA card?

With the ON/OFF option you can temporarily turn off your card so that no one can use it. In addition, you can disable money supply, online and overseas purchases. This setting is available for credit, debit and additional cards (if you are the cardholder).

How do I disconnect the BBVA terminal?

1. To turn on, you need to press the green button until the screen lights up. 2. To turn off you must press the red button key until the screen mentions that it is turning off.

How to activate a blocked card?

Go to the bank branch closest to your home so that, through a consultant, they can assist you in unblocking the card. Some banks, such as Banorte, have a mobile app that allows you to temporarily block or unblock your card if you can’t find it at any time.

How many times can I enter the wrong BBVA ATM password?

If you enter your password incorrectly 3 times, for security reasons your username will be blocked.

What happens when your BBVA account is restricted?

As long as it is maintained, you will not be able to withdraw or deposit money, make or receive transfers (salary included) or pay direct debits, much less make purchases with your card. In other words, the user will lose access to all the money he has.

Why is a debit card blocked?

When verifying an atypical payment by a customer, the card is blocked until it is verified that the customer is actually using it, thus avoiding risks such as cloning the card. If this happens to you, please call the customer service line for guidance.

How long can a debit card be unused?

If your bank account is inactive, i.e. it does not receive deposits or transfer electronic money, the plastic has expired after 3 years of inactivity.

What happens if they deposit me on an expired BBVA card?

An expired debit card is automatically inactive and therefore the cash deposit or transfer will be immediately rejected.

How long does a BBVA debit card last?

Why can a bank account be blocked?

For an expired DNI or NIE Having an expired DNI or NIE is one of the most frequent reasons for blocking a bank account. This is due to the fact that all banking entities are obliged to identify their customers and to have the documentation in order and in force.

What happens if I get deposited into an inactive account?

The bank has the obligation to communicate to the address registered in the account, 90 days before the end of the three years of inactivity, that its resources will go to the global account; however, during this period, the amount deposited remains yours.6 dagen geleden