Costs and commissions And a commission of $9.90 pesos + VAT for inactivity. There is no charge if you make at least one purchase per month.

How much does Santander charge for inactivity?

Costs and commissions And a commission of $9.90 pesos + VAT for inactivity. There is no charge if you make at least one purchase per month.

What happens if I don’t cancel my Santander payroll card?

Not canceling the payroll card can generate a negative balance due to maintenance or inactivity and you will owe a certain amount to the bank.

What happens if I don’t use my debit card for a long time?

An unused debit card can generate a negative balance due to the fees that banks charge. Therefore, the recommendation is that if you do not use or do not want to pay these commissions, cancel.

What do I need to cancel the Santander card?

Submit the cancellation request in writing to any branch, indicating the name(s) and signature(s) of the holder and co-holder(s) of the account, current account number, reason for canceling the account; official identification; cancel the products or services associated with the Account before the settlement of…

What happens if I don’t cancel my Santander payroll card?

Not canceling the payroll card can generate a negative balance due to maintenance or inactivity and you will owe a certain amount to the bank.

What to do to not charge commissions at Santander?

Thus, in order to avoid paying these commissions and for them to be free, the client must comply with the following conditions of employment required by the entity: Domicile a minimum wage of 800 euros. It can also be useful to have a pension of at least 300 euros domiciled.

How much does it cost to maintain an account at Banco Santander?

How do I know if my payroll card is still active?

A salary card can remain active for six months or up to three years, as long as there is no movement or balance in the account. Of course, you have to consider that if the salary card accumulates commissions, it can remain active for many years.

What happens if a debit card is not cancelled?

And it is that if you do not cancel your debit card, you could generate a negative balance due to maintenance or inactivity fees. This amount will be the responsibility of each financial institution.

What happens when you cancel a payroll card?

That’s why you should cancel your salary card after changing jobs, as this will prevent a negative balance from being generated. If, when consulting your account statement, you notice that there are accrued commissions, request the immediate cancellation of your payroll card, although you will have to pay the commissions generated.

What happens if I have a credit card and I don’t use it?

Therefore, it is recommended that you cancel those credit cards that you do not use or need so that they do not appear in your history, this will improve your debt capacity and, with this, also increase the probability that an institution will grant you a loan, credit or loan in case you need it.

How long can I stop using a debit card?

Yes, it is valid for five years.

How long does it take to cancel a debit card?

The deadline is approximately one week from the time your account is fully operational.

What happens to money on a blocked card?

What happens when a card is blocked? The blocking only occurs on the card and not on the account, so the money you have on it is still available and you can transfer your funds or request a cardless withdrawal.

What does inactivity rate mean?

An account is considered inactive when it has not had any movement, that is, no type of transaction such as deposits and/or withdrawals has been registered.

How much does it cost to maintain a Santander credit card?

Commission for monthly maintenance of the credit card account: $659.50 including VAT. National Credit Card Holder Annual Renewal Fee: $7,275.73 including VAT.

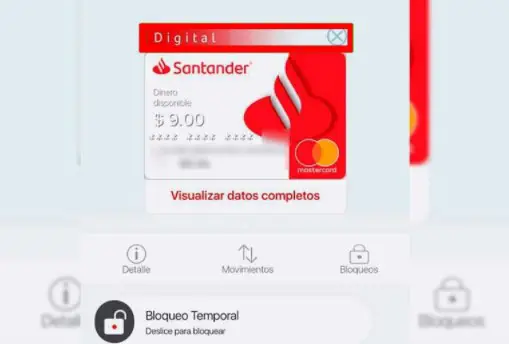

How can I unblock my Santander card due to inactivity?

In the Santander application, enter your global position with your password, display the top menu of three horizontal bars and choose the «Cards» option. Select the card that is temporarily turned off and click “On Turn card on”.

How long can Santander remain overdrafted?

A bank account can be in the red for a maximum of 90 days and, after that period, the bank will consider the debt as doubtful and may provide our identity to organizations that draw up lists of defaulters.

What happens if I don’t cancel my Santander payroll card?

Not canceling the payroll card can generate a negative balance due to maintenance or inactivity and you will owe a certain amount to the bank.

How much does Santander charge for a transfer?

No commissions. Transfers between Santander accounts and other banks, in minutes. Service available 24 hours a day, 365 days a year, with no waiting times.

When can a bank not charge commissions?

The bank cannot charge commission when performing a ‘service’ not authorized by the customer. Inactive account maintenance fee. If the consumer has a bank account that he does not use, the bank cannot charge him an administration or maintenance fee.

How much does it cost to maintain a debit card?

On the one hand, the commission for maintaining a debit card is usually around 30 euros a year at most, while credit cards have a higher cost, which can exceed 50 euros a year, point out in HelpMyCash.com.

How much does a Santander ATM charge to withdraw money from another bank?

Santander, 27 pesos. Banamex, 26.50 pesos. Scotiabank and Multiva, 25 pesos. Banorte, 24 pesos.

What if I never activate my payroll card?

Regardless of whether it’s a payroll or personal account, banks cancel your account if you stop using it for a long period, as long as you don’t have money on your card. Otherwise, commissions will be applied first and your debit account will be canceled last.

What happens if a bank account is not closed?

Condusef details that, after six years without moving a bank account without cancelling, the money will be allocated to public charities. Condusef points out that, after three years without using a bank account, the money in it is still yours.